MyCardStatement is a unified online payment portal that provides the user to do all payments with a credit card inclusive of viewing the card statements after some transactions. MyCardStatement.com has enabled cardholders to handle a diversity of credit card accounts, giving a unified platform where they can pay their bills, and also handle their account online.

In partnership with several financial institutions, such as First National Bank and several others, cardholders can access this website as long as they have access to a reliable connection. Credit card financial freedom and extra monthly charges must be acknowledged, and this MyCardStatement online portal is surely a bonus.

With users’ complete control over their finances and the capacity to view them on every screen size, from a desktop to smartphone, or even a tablet, users cannot trade with the stress of re-enrolling or update the payment data on the MyCardStatement Login portal.

Contents

Registration Procedure For MyCardStatement Portal

If credit cardholders don’t have an online account, they can enroll with the MyCardStatement Login portal. Here are the registration steps which users can register with the relevant identification and verification details:-

- On the official site of MyCardStatement.com, select the Enroll In Now to start the registration procedure.

- Now, enter the 16-digit credit card number and click on the Proceed tab.

- Insert the relevant details in the subsequent three required fields – cardholder name must be entered precisely as it seems on the card, expiration date from the card, and lastly the last 4 digits of the legal entity’s tax credentials certificate.

- Click on the Continue from below.

- Create account username -> Create a new password (see password requirements hereby) -> Enter the valid email address -> Create nickname (as displayed when cardholders log in to MyCardStatement.com) -> Click on the tab Register now.

- Select and answer four security questions from the drop-down menu and even select the one for the future login.

- Users may be questioned to answer the set security question when they log into the official site. -> Click on the Finish tab.

- Registration is complete and users will return to the My Card Statement home page.

Note – The age criteria set up by the officials to get a credit card is 18 years old and individuals must be a resident of the United States officially.

How To Login At MyCardStatement Login Platform?

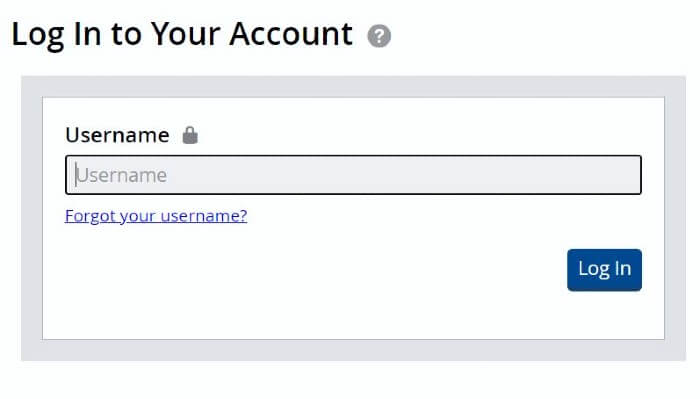

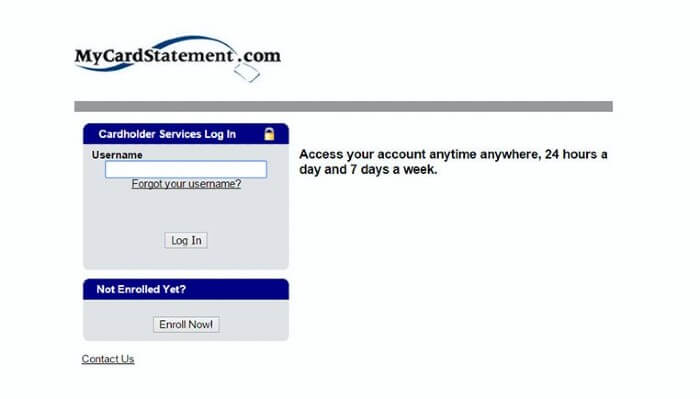

To access the official MyCardStatement Login portal requires prior registration on the official website. The procedure to access your MyCardStatement registration account is as follows:-

- Go to the website www.mycardstatement.com. This can be readily accomplished using cell phones, laptops, or different electronic devices.

- Now, enter the registered login credentials in the sections provided. This incorporates the username and relevant password. Here users will see the “Login” tab.

- Now, click on the “Login” button.

- Once users are logged in to the official site, they can quickly access all the services given by the MyCardStatement Login portal.

Benefits Accessible At MyCardStatement.com

Individuals considering having an online account at the MyCardStatement Login portal can avail themselves of several benefits. From the ease of accessing the MyCardStatement.com site to getting rewards and shopping discounts, users can have them all. Meanwhile, here are some to take note of:-

- Users can have access to currently open and pending transactions.

- Get a complete overview of the account.

- Use paperless bank statements with the MyCardStatement Login portal.

- Submit and report expenses (only accessible for companies utilizing the expense management feature).

- Users can split the transaction among two distinctive debit accounts.

- Check the number of transactions online along with the recent history.

- Cardholders can also view or download bank statements and set up notifications of their every expense.

MyCardStatement Central Features

Analyze the periodic expenses – This is the first and most obvious feature of the MyCardStatement Login portal for your account holders, with which users can keep all the records and history of their daily credit card payments.

Check the account statement – This means that users can comfortably view their bank statements through an online account with MyCardStatement Visa, inclusive of the invoices, payments, etc.

Pay the bills online – Finally, the function at the official site www.MyCardStatement.com, makes daily life more accessible is to pay the bills online with credit cards to circumvent long lines.

| Official Portal | MyCardStatement |

|---|---|

| Online Platform | Access Credit Card |

| Requirements | Credit Card Account Online |

| Benefits | Easy Card Statements Access |

| Financial Transactions | Yes |

Access Credit Card Account With MyCardStatement

Individuals Bank offers the support and buying power of a credit card with confined services from personalities that can be completely trusted. As a supplementary benefit, the MyCardStatement Visa offers a 0.5% discount on all acquisitions made with the registered credit card.

To request a stopover at one of the locations to get or print a Banco de Pueblos visa petition (will open in a new format) and return it to the location at Banco de Pueblos to receive the money.

There are two acceptable ways to pay the Peoples Bank® credit card statement online! Peoples Bank offers free bill pay within Peoples Bank online and mobile with the help of the MyCardStatement Login portal!

Individuals can also make online payments at the official site www.mycardstatement.com and view their Bank Visa credit card statements inclusive of the latest transaction history. When the user clicks on the relevant tab, it opens in a new window.

My Card Statement Account-holders can even call at 712-476-2746 or 877-440-2746 to contact the official customer service or to report lost or stolen cards throughout business hours. External of the business hours, they must call at 800-423-7503.

Convenience To Use My Card Statement Portal

My Card Statement is a possible solution to the hectic schedule of this period and offers several conveniences to the enrolled account holders:

- Receive an electronic copy of the cardholder’s bank statement without going to any bank premises.

- Get all the updates for new banking services, updates, and products.

- Up-to-date knowledge of rewards and rebate awards.

- Shop online doing payments through MyCardStatement Visa and get cashback or future discount vouchers.

- Full access to periodically and annual credit card statements.

- My Card Statement official site is a completely safe, and reliable platform.

- Credit cardholders are notified of the general aspects of the transaction, except the version of the deductions made.

- The voucher obtained on the credit card is automatically arranged in the My Bank Statement cashback offers sections.

Acknowledge Account Statements Online – MyCardStatement Visa

It is officially believed by the firm that smart financial decisions can be performed with a thorough review of credit card statements. With credit card statements for MyCardStatement Visa credit card, cardholders can track credit card expenses, make appropriate payments, withdraw accrued interest, and report delusions.

Another characteristic that the bank statement gives is the name, date, time, and absolute value of the company. For convenience, the possibility of regular credit card billing with a user-friendly design is helpful at www.MyCardStatement.com solely.

This agreement provides cardholders to discover the determined cost of fundraising, which is the quantity of interest accredited to the card throughout a provided billing cycle. EMI cardholders are likewise likely to benefit from this alternative because it assists in determining the accurate amount of withdrawals.

Check the current MyCardStatement Visa credit limit, overdue charges, due date, billing periods, refunds, total bill, etc. this is an attached benefit of traditional credit card billing.

Official MyCardStatement Login Portal Services

MyCardStatement Login portal contains some very convincing and easy-to-use tools and resources. MyCardStatement Visa credit card portal has dramatically gained flexibility for users. These cards are the most trustworthy way to support financial transactions automatically and securely.

Useful tools – It offers several functions to service users so that they do not have to initiate warnings or notifications themselves. Moreover, the account notifications and alerts are transmitted out in a convenient manner so that customers can keep track of the credit card statements.

Save time – In this restless world, individuals may not have ample time to view and review their account credit card statements manually. MyCardStatement Login portal is the best possibility for busy individuals to keep track of their credit card commercial records online.

Printing practice – It’s a comfortable way to prepare a copy of the credit card statement without according to the bank or visiting the bank premises and wasting the eventual productive time in the lines.

Long-term credit card statements – With MyCardStatement Visa portal-registered cardholders can maintain track of the credit card statement for an extended period. For instance, account holders can check their credit card details on the website even you want the ones which are from a year ago and better understand all the periodic expenses at www.MyCardStatement.com portal.

Insured – The financial data online is password guarded and cardholders have security questions (as stated above) that they can solitary answer on thee My Card Statement, so they don’t have to worry about the private data.

Timely information & updates – Registered account holders are informed of online offers and offers that they can buy online in time to take benefit of them.

These reliable online services for all the enrolled credit cardholders are accessible to those who have completed the registration procedure online at www.mycardstatement.com. MyCardStatement Login comes with a diversity of convenient and easy-to-use tools and portal features.

This means clients don’t have to re-register or configure enduring notifications. Also, cardholders don’t require to re-enter the payment data that they set up all the time. The MyCardStatement online portal can be utilized with all contemporary browsers. However, it is recommended that account holders must utilize Google Chrome for every MyCardStatement Login site.

Basic Guidelines & Assistance For MyCardStatement

To avoid being examined with any type of fraud, the cardholder must have some basic knowledge of some of the credit card statement modifications. Instructions comprise of the username, login address, and also the email address.

Expiration date – At the official portal, each credit card transaction is shown on the regular bank statement inclusive of the card fee. The relevant charges must be paid with respect to the due date.

Minimum owed – The smallest amount that the My Card Statement cardholder must give to the credit card organization is 5% of the total amount owed. This is the card’s customary payment method along with the MyCardStatement Login portal.

Credit limit – Cardholders can withdraw the maximum amount of credit on their card. Cards are issued with a credit limit based on certain factors, such as salary and acceptable credit in their account.

Exceptional credit accessible – The total amount that cardholders need to pay to the credit card organization is determined by the cardholders who have paid the relevant payments through the credit card.

Transaction history – The credit card statement includes complete data about the cardholder’s transactions, the date, and the merchant’s name, inclusive of the amount made on a particular day and time. If users are inquisitive about a transaction, they can inform the credit card organization of the transaction.

Rewards and Refunds – The credit card statement displays the various reward points that a user can optionally utilize. This is a MyCardStatement portal provision that several credit cards incorporate to the satisfaction of their valuable users.

A thoroughgoing analysis of the payments with the credit card statements can help the respective cardholders to gain actual insight into monetary decisions. MyCardStatement Login portal keeps account holders up to date with the credit card statement particulars, make relevant payments on time, avoid interest costs, and report errors if any.

Last Words About MyCardStatement

The credit card statement is a review of all the cyclic transactions in the format of an invoice which can be easily accessed at www.MyCardStatement.com. The credit card receives the monthly card statement along with the notification for at least 21 days before the subsequent payment date. It normally arrives in the mail, but after opting particularly for an online statement, you’ll require to register on the credit card official website.

This is significant because it gives a better knowledge of all the payments, acquisitions, charges, and credit issues that the credit card holder makes. Overall, for various pages, it’s most beneficial to explain slowly to see whereby the billing cycle has been shaped and if the relevant client if owe a credit card balance.

My Card Statement cardholders will get general data about the transaction, except the summary of the judgments made. The original receipt received along with the credit card is automatically arranged on my account statement.

Credit card businesses are constitutionally obliged to send the monthly credit card statement with all the particulars to their respective cardholder at least 21 days before the subsequent payment date. Individuals can discover more data about My Card Statement on the official site of this portal.